- January 2, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

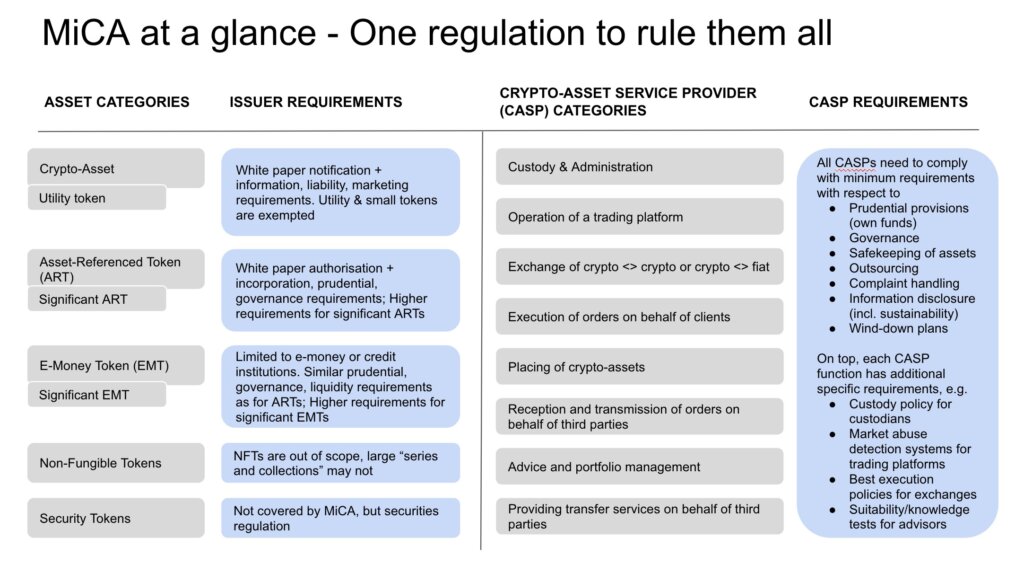

MiCA is now live across the European Union, marking a milestone for digital asset oversight. Industry participants now operate under an EU-wide framework that covers stablecoins, token issuances, and services such as custody and exchange.

As the Bretton Woods Committee wrote, the process involved years of consultation and negotiations, culminating in a rulebook that addresses oversight gaps and promotes transparency.

Companies that issue e-money tokens (EMTs) must be incorporated in the EU or hold relevant e-money licenses, while asset-referenced tokens face higher disclosures and governance requirements when they reach certain volume or user thresholds. The measures also include stricter rules on reserve management, redemption, and disclosure, signaling the bloc’s focus on financial stability in digital asset markets.

Patrick Hansen, Policy Director at Circle, wrote an extensive piece explaining how stablecoin issuers have little choice but to comply or lose access to the entire EU market. Tether, the leading stablecoin issuer in the world, chose the latter option, telling CryptoSlate that the competition is frustrated by its differing approach to stablecoins. He said,

“Every day you wake up, you scratch your head and you don’t understand why these couple of Italian guys are doing a much better job than you. Of course you become frustrated, right?

So You know, if your business model is named Kill Tether, then you know, you should rethink about your product.”

Expectations for crypto companies in the EU

Crypto-asset service providers (CASPs) offering activities like brokerage, exchange, or custody face licensing requirements that allow them to operate across all member states once authorized in one jurisdiction. That shift replaces the previous patchwork of national regulations, reducing barriers for firms that seek cross-border growth and providing a passport-like mechanism similar to the approach used in traditional EU financial services.

Some businesses are expected to consolidate or forge partnerships because compliance obligations may be harder to fulfill for smaller ventures. Trading platforms must also establish controls against market abuse and insider trading. Authorities can prohibit token offerings if disclosures or risk management procedures appear incomplete.

MiCA formally excludes protocols running “in a fully decentralized manner” from its scope, but many operations may fail to meet the threshold for true decentralization.

The same ambiguity appears around large-scale NFT collections, which the regulation might treat as fungible, requiring compliance with white paper and issuer obligations. Uncertainty also surrounds “privacy coins,” which may face delisting if complete holder identification proves impossible.

Overall expected impact of MiCA

Industry responses from Bretton Woods and Circle indicate a shared view that MiCA’s practical success relies on its technical standards and enforcement practices. Companies are adapting product offerings, focusing on clarity in disclosures and compliance with rules for token issuance and reserve management. As Hansen observed, the framework’s adoption may attract projects seeking certainty, especially if concerns over enforcement actions elsewhere persist.

There are broader questions about global adoption. The U.S. has yet to formalize stablecoin regulation, and enforcement patterns, while seemingly progressive, vary widely across Asia. The European model could influence other jurisdictions, prompting a “race to the top” in consumer protection and alignment with international standards.

According to Bretton Woods, a coordinated approach would foster passportability for stablecoins and mitigate risks of regulatory arbitrage. Some lawmakers have discussed a MiCA 2.0, indicating that non-fungible tokens, DeFi, or additional technological features might eventually be revisited under an updated directive. Officials note that any new iteration will depend on the law’s initial results.

Hansen points to MiCA’s similarities with other EU tech initiatives, where region-wide standards ultimately influenced commercial and legal frameworks abroad. Whether MiCA becomes a default global reference will depend on its real-world implementation, the role of national agencies, and how effectively the measures safeguard markets while allowing firms to innovate. Meanwhile, corporate moves to secure a MiCA license continue, with major banks and exchanges adjusting business lines or acquiring smaller players.

Many expect MiCA to bring more institutional involvement, aided by uniform licensing and consumer protections. The cost of compliance, however, remains a factor that could shift activity toward well-capitalized platforms. Investors may see a broader adoption of regulated services, while smaller teams might concentrate on specialized niches or relocate to regions where obligations are less strict. Policymakers have pledged to monitor the outcome, believing a unified EU stance on crypto can bolster capital formation and user safeguards.

As the framework applies, stablecoin issuers and CASPs face earlier enforcement deadlines than other market participants, while the remainder of the rules phase in over the year. Regulators will also issue binding implementation standards that clarify timelines, technical disclosures, and operating conditions for token projects.

Hansen confirms that firms planning to navigate the European landscape are engaging with authorities and preparing compliance strategies accordingly. He believes MiCA has created an environment of clear responsibilities for participants, and its ability to encourage responsible growth under consistent rules will measure how it shapes crypto markets.

Implementation continues in stages as the EU refines technical guidelines and supervises licensed entities. The outcome will reveal whether MiCA is a workable model that balances innovation with oversight.

The post MiCA goes live in Europe as the crypto regulatory framework starts with stablecoins appeared first on CryptoSlate.