- November 28, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

The world of financial assets has a well-known pattern: a surge in asset prices prior to expected positive developments or ‘good news,’ followed by a notable slump when the event occurs. This phenomenon, often referred to as ‘buy the rumor, sell the news,’ suggests the interplay of strategic, perhaps institutional, buying and retail investors often left buying at the peak.

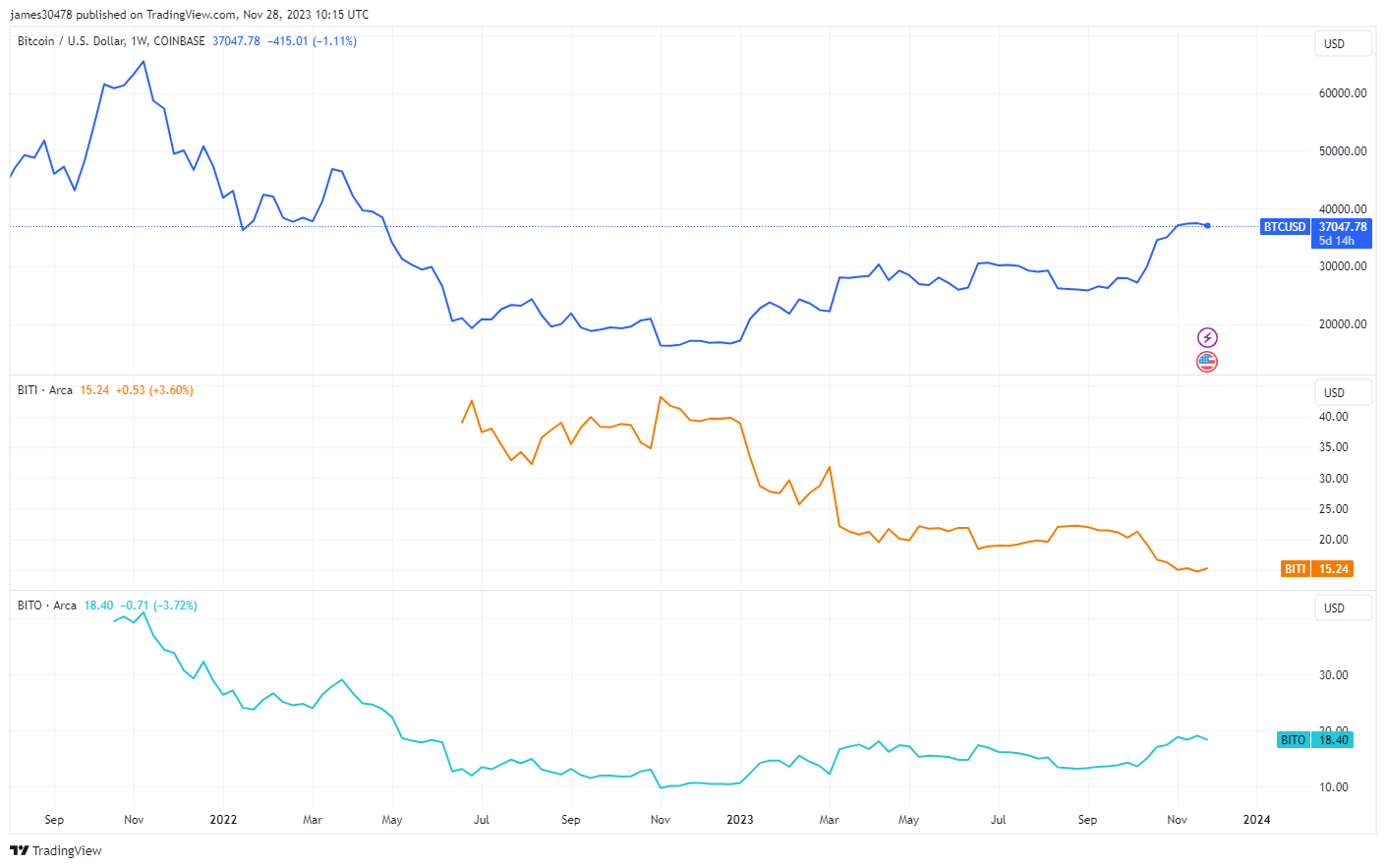

For instance, the ProShares Bitcoin Strategy ETF (BITO) launch in October 2021 coincided with the peak of the bull market for crypto. This event accumulated over $1 billion in trading volume and marked a top in the cycle. Conversely, the BITI ProShares Short Bitcoin Strategy ETF, which offers investors the opportunity to bet against Bitcoin, marked a local trough in June 2022 amidst the Luna collapse.

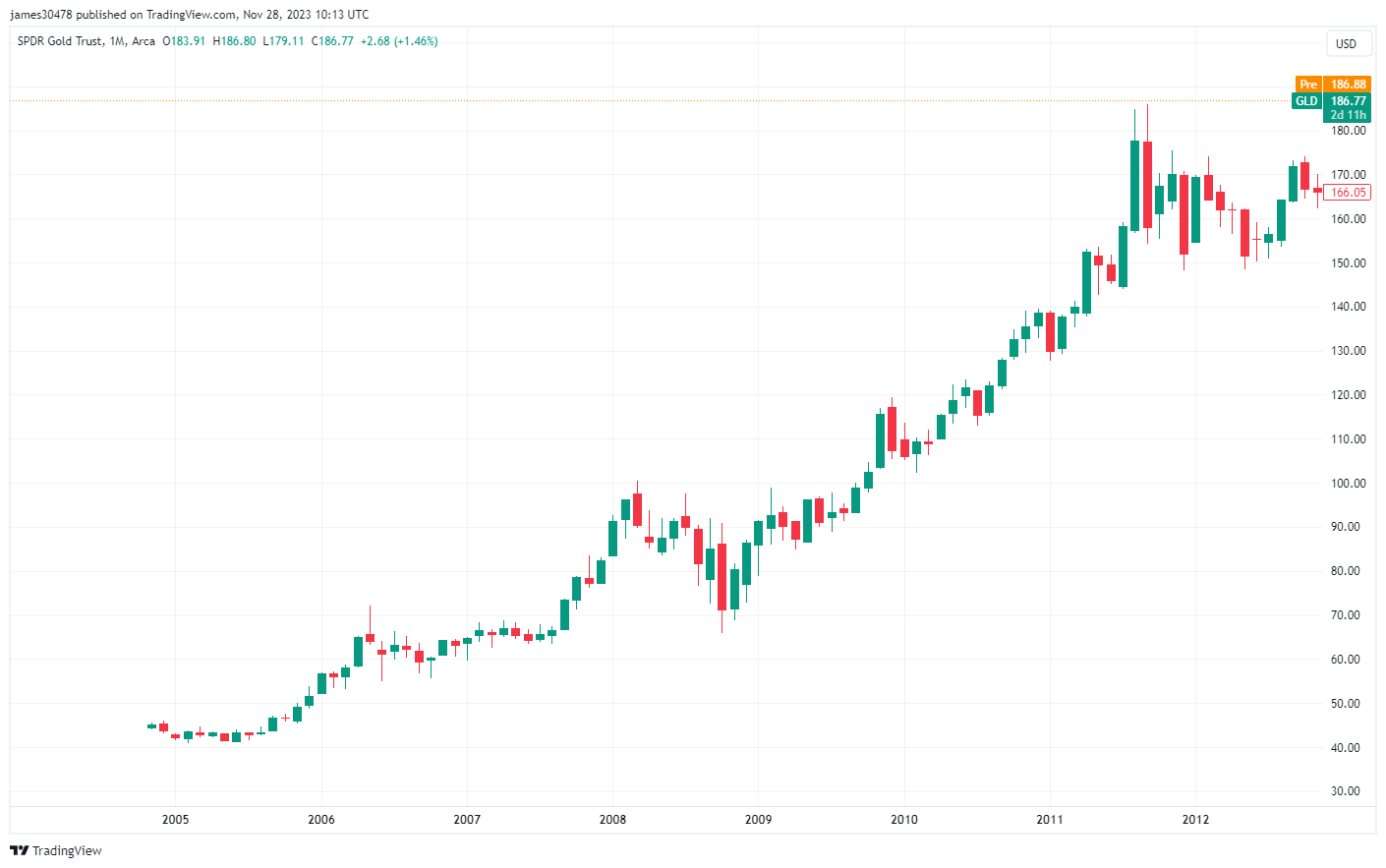

This pattern isn’t limited to digital assets. When the Gold ETF (GLD) was introduced in November 2004, it opened around $45 and dropped to approximately $41 by May 2005. However, it saw an impressive 268% increase over the subsequent seven years.

The post ProShares ETFs exemplify ‘buy the rumor, sell the news’ in crypto markets appeared first on CryptoSlate.