- June 17, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post SPX6900 Cools After Parabolic Rally, SPX Going Back To $1.77 ? appeared first on Coinpedia Fintech News

- SPX Price rallied over 230% from May to mid-June, peaking just below its all-time high of $1.77.

- Open Interest surged to $171M before a sharp 25% decline, suggesting overleveraged longs were flushed.

- Spot outflows hit $6.4M on June 14, signaling strategic exits

SPX6900USD Technical Analysis: A Classic Parabolic Advance

The rally was triggered by a golden cross on May 6, when the 50-day EMA crossed above the 200-day EMA—a bullish signal in technical analysis.

Following this crossover, SPX coin accelerated through successive resistance zones, kicking off a multi-leg parabolic advance.

SPX Price followed a textbook parabolic rally between May 7 and June 11, rallying from $0.50 to almost break its previous all-time high of $1.77 in just over a month. The move unfolded in four accelerating legs, each followed by shallow pullbacks.

This structure often signals a blow-off top or exhaustion phase, especially when volume and sentiment spike at the peak.

A temporary top formed on June 11 as the SPX price began to fade under $1.70. The correction intensified on June 14, driven by heavy profit-taking, and is now consolidating above key support at $1.30.

Indicators Point to Cool-Off, Not Collapse

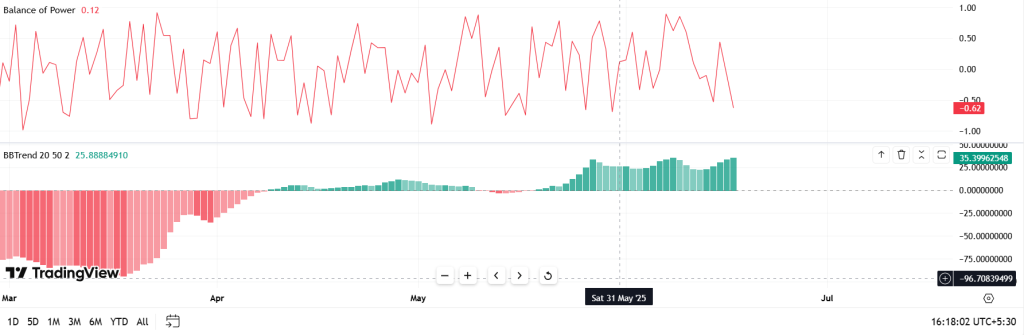

- RSI has dropped from 75 to 40.19, cooling from overbought territory.

- MACD shows a bearish crossover, confirming waning momentum.

- Balance of Power is soft at 0.12, while BBTrend and BBP show weakening bullish energy.

The indicators align with a standard post-rally reset. A base is likely forming between $1.30–$1.35.

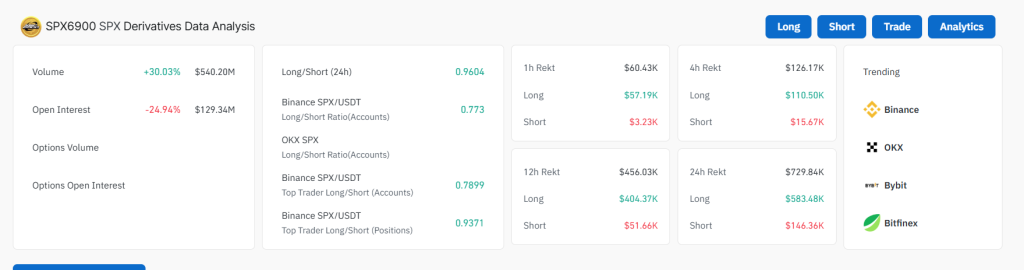

Derivatives Flash Warning: Open Interest Collapse, Sentiment Flip

Open interest reached an ATH of $171.7M on June 13, but rapidly fell by 25% as the price retraced. At the same time, long/short ratios flipped bearish across major exchanges:

- Binance L/S (accounts): 0.773

- 24h Global L/S: 0.9604

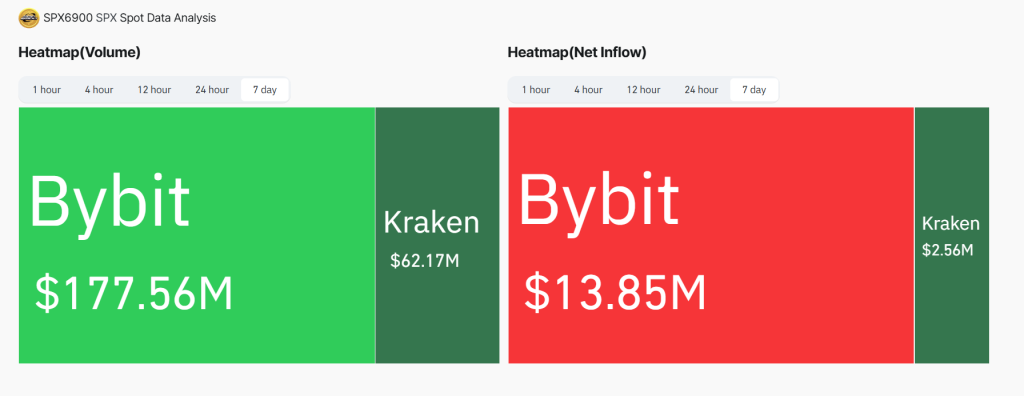

This shift indicates that traders began aggressively closing long positions or opening shorts as the rally lost momentum. Bybit, which led trading volume with $177M, also saw over $13M in net outflows.

Spot Flow Reversal Confirms Profit-Taking

On-chain flows show over $6.4M in net outflows on June 14 alone, with additional daily exits continuing through June 17. Coinbase saw light inflows (~$367K), but Kraken and OKX recorded significant net exits, confirming that the move was not retail-driven accumulation but strategic unloading.

SPX6900 Price Prediction: Bounce or Breakdown?

SPX coin trades at $1.39. Holding $1.30 support could see price test $1.50 and potentially retarget the $1.71 ATH by late June. A breakout may push SPX toward $2.00.

If $1.30 fails, downside targets include $1.18 and $1.05 (Fib retracement levels).

For now, SPX shows signs of stabilizing. Traders should watch for volume return near $1.50 and RSI flattening to confirm bullish continuation.

SPX6900’s rally followed technical structure, and its cooldown reflects healthy market rotation. A breakout or breakdown in coming sessions will define the next meme cycle leg.