- May 17, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

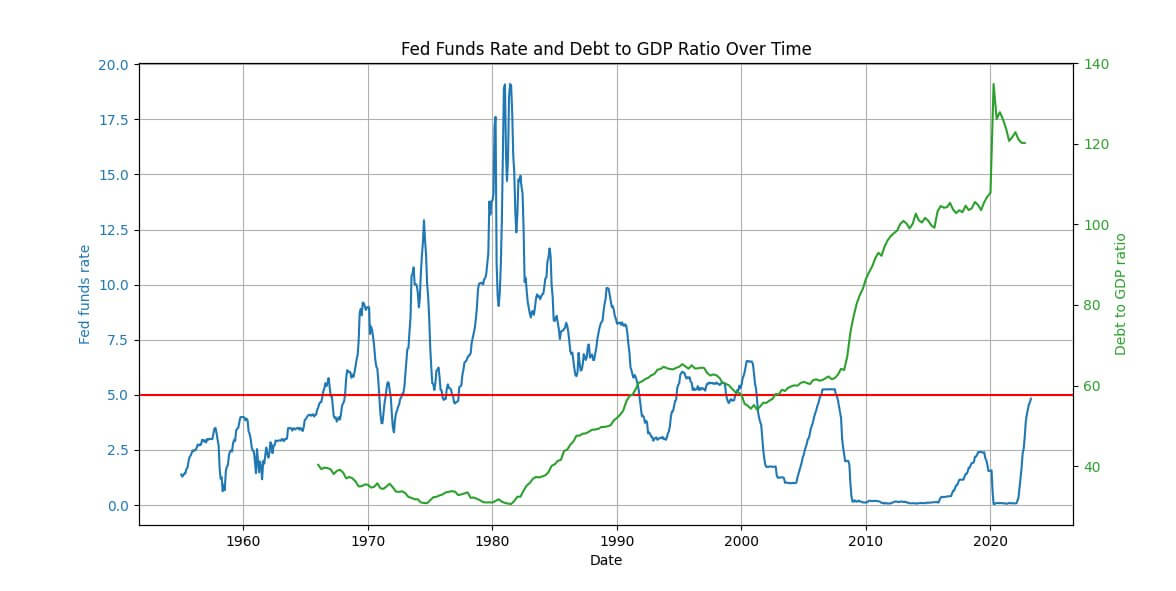

- The average Federal Funds Rate from 1955-01-01 to 2023-05-17 is 4.62%. We are now in a normal regime of interest rates.

- The issue now becomes the total debt to GDP — which is roughly 120% — so as rates stay elevated, it will cost more to service the interest.

- As it becomes more expensive to service the debt, this will eat into other sectors and shrink their pie, such as health care and education, and society will break down further.

- Looking out to FY 2032. interest costs are projected to hit $1.2 trillion, which will be the largest expenditure program, surpassing Medicaid ($789 billion) and defense ($990 billion).

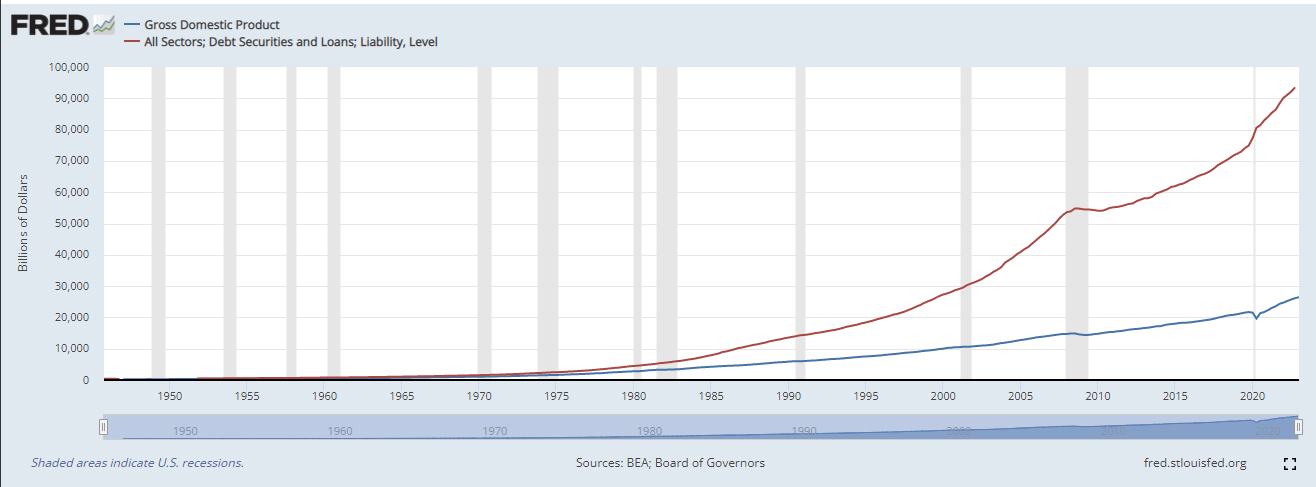

- The only way would be to grow GDP ahead of the debt securities and liabilities, but that looks extremely unlikely — especially with an aging population and declining population.

The post The average Federal Funds Rate from 1955 to 2023 is 4.62% appeared first on CryptoSlate.