- November 23, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

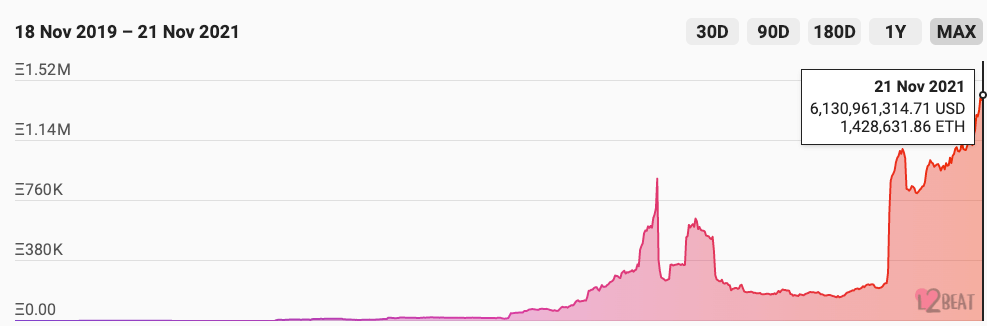

According to data from analytics platform L2BEAT, there has never been more value locked in Ethereum’s layer-2 scaling solutions.

With increasing gas fees driving the adoption of networks such as Arbitrum, Optimism, and Loopring, layer-2 TVL increased by more than 44% in less than a month.

Users pour their money into L2s as Ethereum fees skyrocket

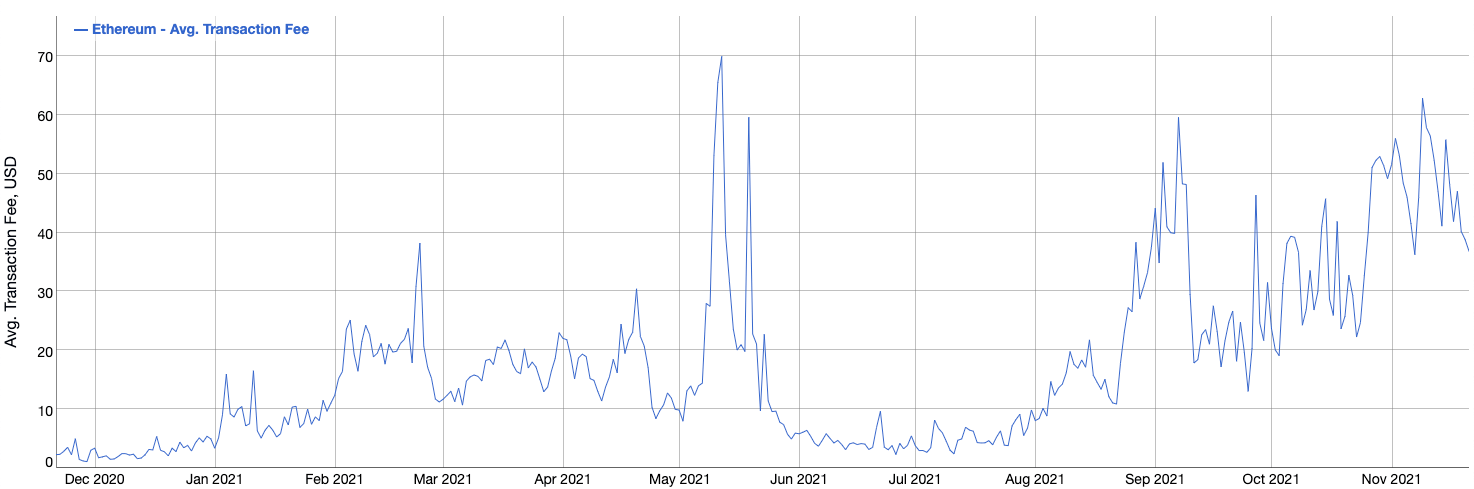

With the average transaction fee on Ethereum inching dangerously close to its all-time high, the network has become increasingly unattainable for the average user.

And while the price of transactions has managed to consolidate around $36, data from BitInfoCharts showed that the average transaction fee on Ethereum cost over $62 at the beginning of November.

This has pushed a record number of users to the network’s Layer 2 solutions, which offer drastically lower fees and much faster transaction finality.

According to data analytics platform L2BEAT, the total value locked (TVL) in Ethereum’s Layer2 solutions has reached its all-time high, surpassing 1.4 million ETH. At current prices, this equates to around $6.13 billion.

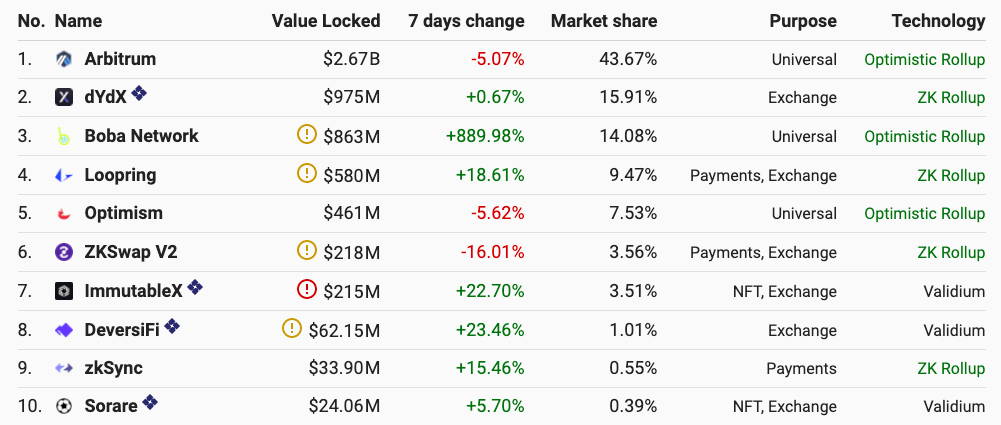

Arbitrum accounts for the largest share of the Layer2 market, capturing just over 43% of the TVL, worth around $2.67 billion. dYdX ranks second with a 15% of market share worth $975 million, while the newly launched Boba Network came in third with $863 million.

The more well-known Loopring, Optimism, and ZKSwap V2 have $580 million, $461 million, and $218 million in TVL, respectively.

The data seems to support the overall market sentiment towards Ethereum. Even the industry’s most prominent investors have been vocal about Ethereum’s fee problem, with many actively exploring engaging with its competitors such as Avalanche.

The post There’s over $4.2 billion locked in Ethereum layer-2 protocols appeared first on CryptoSlate.