- October 14, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

When it comes to NFT marketplaces, everyone and their grandmother have heard about the likes of OpenSea and Top Shot. But, what about the hidden places you simply cannot afford to miss as a connoisseur of digital assets? Read on to learn more about lesser-known NFT marketplaces which sometimes go undeservedly unnoticed but whose best years are surely ahead of us.

1) Hic et Nunc

Image source: https://www.hicetnunc.xyz/

Dappradar puts this one in 5th place in the most used category. It runs on the Tezos blockchain which provides it with two essential features: it is a highly energy-efficient platform based on the Proof of Stake Protocol (in comparison with Ethereum, for example) that also keeps its minting prices low. For the sake of comparison, gas prices for minting an NFT on Tezos can go as low as 10 cents, while on Ethereum this figure can go up to 100 dollars.

In addition to creating and selling one’s artwork, HEN supports making collections and reselling the works of other artists on the secondary market. The platform is designed with the support for cheap purchases of domain names upon the creation of the user’s account and its integration with the user profiles. Domain names can be bought from GoDaddy.com or NameCheap.

All the transactions taking place on HEN can be easily viewed with the help of the TzKT Block explorer. Users are able to search for individual transactions for various wallets or Aliases, and receive real-time alerts whenever the artists of their interest plan to make new drops.

All of these features translate into broader global accessibility in line with the vision of its original developer Rafael Lima who envisioned Hic et Nunc as a decentralized public smart contract infrastructure. The fact that it runs on Tezos, allowed Hic et Nunc to promote itself as a greener option, which is why it continues to attract more ecologically minded artists affiliated with the #GreenNFT movement.

Also, this marketplace has managed to build a solid reputation for its open-door policy in which the artists of all profiles put the effort into building a socially-minded and welcoming community.

2) Kalamint

Image source: https://kalamint.io/

Similar to its competitor Hit et Nunc, Kalamint also ranks among the top ten most used NFT marketplaces. The similarities do not end there, as this platform is also built to promote energy efficiency on the account of running on the Tezos blockchain. Based in Bengaluru (India), Kalamint operates as the premier digital art gallery in this country and helps artists promote their work on the blockchain. The fees are kept low based on Tezos infrastructure, with minting presenting an affordable and more accessible alternative to other platforms, especially when their fees present the NFT artists with too high a barrier for entry.

Despite promoting easier access for artists, Kalamint avoids marketing itself as a platform for cheap artwork. Instead, this marketplace has implemented artist selection and approval procedures that allow only validated artists to mint their NFTs. Validation during the application process involves checking the identity of all artists as a way to minimize copyminting on the platform. Upon registration, artists and other users on the platform are made part of the decentralized decision-making process in the preparation of new releases.

To further protect the platform against copyright infringement, Kalamint has implemented the NFT Registry mechanism which provides separate smart contracts that track down all assets created on the platform. This allows for easy verification of the origin of each individual NFT that has ever been minted on the platform.

In addition, the FA2 token standard which Kalamint adopted as a Tezos feature provides an integral token contract interface and the support for a broad range of token types and multi-asset contracts.

Participants are also eligible to earn $KALAM tokens which are distributed weekly. At the moment, these tokens are used for liquidity mining and farming while the developers plan to make them the means of payment and governance on the platform in the near future.

Kalamint recently drew mainstream attention for being selected as the platform for launching the NFT series about the life of the legendary hip-hop artist Tupac Shakur that will include a documentary on the rapper’s life as well as a book with unique artwork. Also, the platform made headlines for receiving funding from Tim Draper’s blockchain venture studio and fund Draper Goren Holm (DGH).

3) OneOf

Image source: oneof.com

Oneof is the music-focused marketplace for ecologically minded NFTs. The focus on the green operation (OneOf is marketed as using 2M times less energy per NFT than its competitors) is put to practice by having the platform run on Tezos’ proof-of-stake network. The network provides OneOf with energy efficiency as well as the ability to self-amend and easily introduce regular updates and innovations. Low minting costs mean that OneOf can deliver on its promise of focusing on artists and fans, acting as the bridge between these two with attractive prices to boot.

OneOf Marketplace implements the Credit system which refers to the net payment the users get from posting their OneOf NFTs for resale on the platform. At the moment, the Marketplace Credits are denominated in USD, no matter what currency the buyer pays in. Users can immediately use up to 100% of their Marketplace Credit for purchases or bids on other NFTs on the Platform.

Any Marketplace Credit from the resale of NFTs becomes available for withdrawal to supported U.S. bank accounts linked with OneOf after an applicable waiting period ends.

The Resale Royalty is a symbolic percentage of the sale price that goes back to the artist or NFT creator. Whenever NFT changes ownership on the marketplace, a favored artist supported by the user receives a small percentage from the sale while the seller gets the majority of the proceeds (90% or more). Most of the NFTs purchased from the OneOf drops can be listed for resale on the Marketplace as soon as the primary sale is finished.

To support its music industry roots, the platform was initially launched with the support of legendary American musical performer and producer Quincy Jones. Recently, popular American singer Doja Cat chose OneOf as the platform to promote her set of NFT goodies which include approximately 26,000 limited-edition collectibles including various tokens and other goodies.

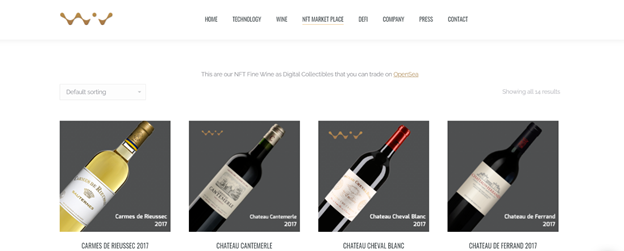

4) WiV Technology

Image source: WiV

WiV offers a secure NFT marketplace that promotes itself as the platform under whose umbrella the producers, buyers, and sellers can meet for mutual benefit. But, there’s a catch – WiV uses its Polygon chain to support trading in fine wines at a much lower cost and with a greater deal of security for all parties involved.

As the first platform to offer NFTs backed by physical assets of this type, WiV aims to expand beyond wine trading to other physical assets. Users will be able to gather and keep information about the origin and transaction history for each asset. At the same time, a unique asset of their choice will be stored and professionally managed at a dedicated facility. Finally, WiV users will be able to sell and offer both old and new-minted NFTs in the marketplace as well as trade WiV NFTs with the support of the smart contract infrastructure.

To make this easier, Wiv offers multi-chain support i.e. multiple smart contracts from different chains, including ERC-721 and ERC-1155 smart contracts. At the same time, the platform’s NFT trading engine provides the users with the ability to organize auctions and private sales.

NFTs on the platform can be organized into categories under individual collections. Royalties from the secondary market trading in the Wiv marketplace are made available for the collection creators and contract owners. At the same time, users can create their own NFTs for use in individual collections. The idea is to support the option for each consumer to put their wine in the blockchain and make it redeemable with the help of any designated agency or organization.

The digital wine cellar is yet another feature of the Wiv marketplace and it functions as a display room for all NFTs. From it, all assets are immediately viewable in 2D and 3D and made available for digital interaction. Users can freely browse their virtual collection, get information on the producers and vintage and share wines with their friends.

5) Unifty

Image source: www.unifty.com

Unifty is a multi-chain platform that promotes the concept of the creator-focused economy. When it comes to NFTs, this concept is based on securing access to a range of tools for NFT artists that will allow them to do their work without having to learn complex coding. In this manner, Unifty hopes to lower the admission bar for many artists with a vision which is sometimes not supported by sufficient technical know-how.

Also, the goal is to bring down the development costs for them to an absolute minimum to offer as broad access as possible. This means that NFTs can be created at a low cost while the platform will also support hiring other developers to do this job for others.

The platform allows users to bid or buy NFTs by using a credit card or bid on unique items. It allows for easy monitoring of the activities relating to one’s favorite artists that can organize drops. Items can also be resold on the OneOf Marketplace.

Full ownership is supported based on contracts and the Unifty prides itself on being able to support trading, minting, and creating NFTs with few clicks only. This is why it is usually described as offering software-as-a-service functionality with which the platform hopes to attract not just artists, game devs, and content creators, but also community curators and other NFT platforms.

The Unifty tools can be used by art curators and crypto communities to collect and distribute individual NFTs among their members. Unifty will also support the streamlined development of decentralized offerings for business networks, particularly the creation of custom storefronts with Shopify and Joomla-like features without the need to have a background in crypto technologies.

Unifty also provides CAAS (Contracts As A Service) solutions to allow digital artists to draft their own contracts without coding knowledge. The services include a collection of contracts and pre-made dapps, pre-sale auctions, farms, NFT swapping functions, etc.

The NIF token is a utility token used for NFT valuation and exchange. NIF can be used to offset unbalanced NFT swaps and get discounts on tools.

6) Drops

Image source: Drops.co

Drops is an NFT marketplace that basically operates like a sandbox with various trading, loan, staking, and other asset management options. The platform primarily gives access to loans for both DeFi and NFT assets. The Drops allows its users to open a permissionless lending pool.

Once this is done, the NFTs and unused DeFi tokens can be used to secure access to loans and allow the users to profit from extra yield. Any type of assets can be used as collateral based on the lending pools supported under the Drops’ protocol. These include NFTs in the form of collectible or financial assets as well as DeFi tokens and other items. Drops aims to become a leading platform for NFT users who are after a wider range of yield farming, staking, vault, and loaning options.

One of the key features the Drops relies on to achieve this is the option to borrow against DeFi and NFT Tokens. This should lower the opportunity cost of holding governance or liquidity tokens by offering them as collateral and earning returns on short-term loans.

A user’s NFTs can be used for loans as well, by being turned into collateral and getting instant access to trustless loans without having to negotiate with the lenders or wait for the approval.

At the same time, idle assets can be transformed into active yields by allowing users to extract the most value from their portfolios. This is done by supplying governance tokens or stable coins to NFT lending or fungible pools, with returns and rewards being offered as compensation.

For B2B, this should mean lowering the pressure to sell NFTs based on the lack of ROI while keeping the value of investments. At the same time, the B2C users get access to instant liquidity and earn yield with the help of NFTs.

7) Hoard Exchange

Image source: hoard.exchange/

The Hoard Marketplace is the platform for trading, buying, selling, renting, and loaning NFTs as part of a dedicated ecosystem designed to support these activities. This includes digital artwork, in-game items, domain names, etc. Hoard Exchange aims to provide infrastructure for integrating digital assets with the Ethereum blockchain.

In 2021, it introduced the flash loan feature in which the borrowers take, use, and repay uncollateralized instant loans as part of the transactions. If they are unable to repay them, the whole transaction will be reverted and nullified as if it never took place, freeing the lender from the risks usually associated with traditional loans. As such, flash loans are often used for collateral swap, arbitrage, or self-liquidation.

HRD is the platform’s native token. Its total supply is capped at 1 billion, with 48% earmarked for the distribution to the community. Token holders can perform transactions, engage in staking, and are eligible to receive compensation and cast their votes. They can also act as HRD liquidity providers on decentralized exchanges.

Borrowers can use NFTs as collateral to apply for a loan. Loans are paid off based on the rules defined by the lenders who give access to funds.

On Hoard, holders of stablecoins who are looking towards earning a profit can become lenders. The platform allows them to use their funds to earn the profit in their sleep and get access to NFTs of their choosing in case there is foreclosure. The lenders get their NFTs used as collateral if a loan is not repaid on time or as agreed.

Borrowers deposit NFTs into the Marketplace protocol and define a minimum loan value. The platform users who own ERC20 and ERC721 assets can use their crypto assets as collateral. If they repay the loans before the due date, the funds increased by interest go to the lender while the NFTs used as collateral goes to the borrower.

Finally, stakers on the Hoard platform can get access to financial returns if they invest in HRD. Associated fees are paid on tokens with strong liquidity.

Image source: DepositPhotos.