- January 5, 2026

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Venezuela’s $60B Bitcoin Holdings Could Trigger a Global Supply Shock appeared first on Coinpedia Fintech News

Bitcoin jumped to $93,000 as the U.S. forces took Venezuelan President Nicolas Maduro into custody over drug trafficking charges. Beyond the headlines, crypto markets are focused on a bigger issue.

Reports suggest Venezuela may hold around $60 billion in Bitcoin. If true, this could impact Bitcoin prices and the broader cryptocurrency market in 2026.

Venezuela To Have “Shadow Reserve” of Bitcoin

According to intelligence reports cited by Whale Hunting researchers Bradley Hope and Clara Preve, Venezuela’s government may have built a hidden Bitcoin and stablecoin reserve worth between $56 billion and $67 billion.

The accumulation reportedly began around 2018, when Venezuela started selling gold from the Orinoco Mining Arc and converting part of the proceeds into Bitcoin.

Estimates suggest that roughly $2 billion in gold may have been exchanged into Bitcoin at prices near $5,000, resulting in around 400,000 BTC. At early-2026 prices near $90,000, that tranche alone would now be worth about $36 billion.

How Sanctions and Oil Sales Played a Role

As U.S. sanctions tightened, Venezuela is believed to have required oil buyers to settle payments using USDT (Tether). Over time, intelligence suggests some of this USDT was converted into Bitcoin to reduce the risk of address freezes.

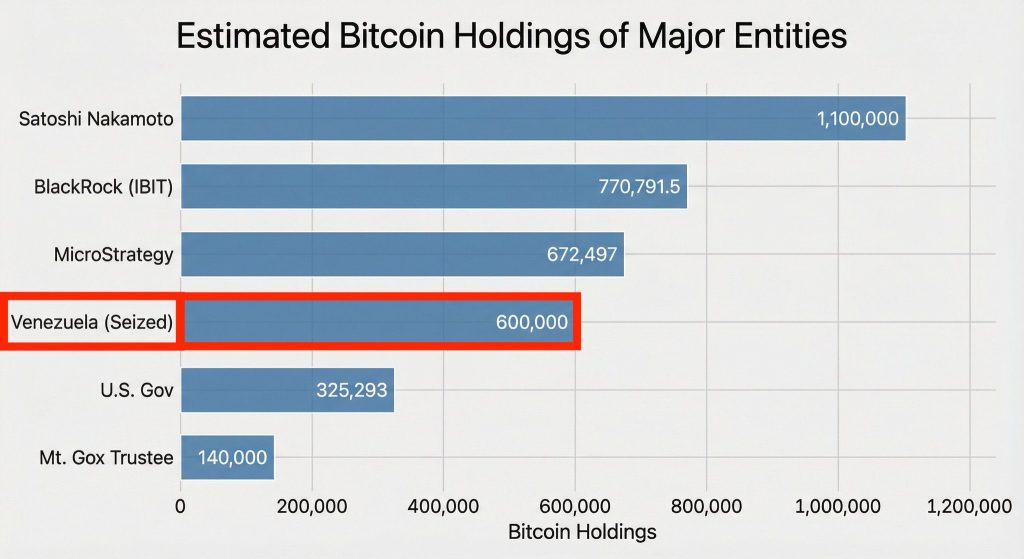

Additional sources of crypto accumulation reportedly include seized mining operations and crude-for-crypto arrangements between 2023 and 2025. Combined estimates point to 600,000 BTC or more, placing Venezuela among the largest Bitcoin holders globally, alongside BlackRock and MicroStrategy.

Why This Matters for Bitcoin Supply and Prices

To put this into context, Germany’s sale of 50,000 BTC in 2024 caused a 15–20% market correction. A reserve 12x larger presents a very different scenario.

Analysts say three outcomes are possible:

Frozen assets: The U.S. could seize the Bitcoin, and it would be held by the Treasury and cannot be moved or sold.

Strategic reserve: The U.S. may choose to keep the seized Bitcoin as a strategic reserve instead of selling it. This will support Bitcoin prices over time.

Fire sale: The least likely outcome is an emergency liquidation. In this scenario, the U.S. DOJ could sell it quickly through platforms like Coinbase Prime or U.S. Marshals auctions.

Impact on Crypto Markets in 2026

If these assets are frozen or held as a strategic reserve, the result would be a major supply lock-up, similar to a long-term institutional hold. That could support higher Bitcoin prices in Q1 2026, despite short-term volatility.

While uncertainty may cause sharp price swings, many analysts see this development as structurally bullish, especially compared to traditional conflict-driven sell-offs.

Markets may soon realize that Venezuela’s real influence lies not in oil, but in Bitcoin.