- May 12, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The modern practice of inflationary monetary policies has drastic, wide-reaching effects on the economy.

Over the last 40 years, monetary policy has caused interest rates to decline from a high of around 20% down to the zero bound. During the same period, the U.S. dollar (USD) money supply has expanded at a rate never before seen in modern history and asset prices in dollar terms exploded to the upside, all while the U.S. average hourly wage has lagged on an unprecedented scale.

Ironically, the growing wealth gap, caused by lagging wages and rising asset prices, has occurred while the Federal Reserve (Fed) has been targeting a 2% inflation rate and pushing the narrative that inflation is good for the economy, good for economic growth and, most of all, good for the average Joe. This makes us wonder why the Federal Reserve, through monetary policy, is adjusting interest rates and setting inflation targets and whether this intervention is really benefiting the economy.

To start, let’s focus on the question: Why are we seeing this intervention from the Fed? The United States has a total debt to Gross Domestic Product (GDP) ratio of 257%.¹ This fragile debt house of cards, which the Federal Reserve has created, has caused them to fear deflation and its effects on the economy. The Federal Reserve is then essentially forced to intervene so that they are not perceived as the ones allowing the economy to collapse. They do this primarily through the lowering of interest rates and through inflation, or in other words, a debasement of the currency through an expansion of the money supply. This intervention leads to an increase in consumption, asset purchases and malinvestment, which, in turn, leads to an ever-increasing debt burden and an ever-greater deflationary headwind on the economy. The cycle then repeats itself with the Fed having to intervene time and time again. The Federal Reserve is stuck in a negative feedback loop which they themselves have created.

What Are The Side Effects Of Inflation?

First, let’s look at the effects of inflation from the consumer perspective. Let’s imagine for a second that the government suddenly doubled the total supply of dollars in the system. In theory, everything would double in price as the value of the currency would be halved. Now, the producers of a product or service essentially have three options:²

- They could double the price of their product or service to maintain their current margins. The side effect of doing so is that they will most likely drive away customers.

- They could maintain the current price. The side effect of doing so is that they will take a hit on their margins and their bottom line.

- They could maintain the current price but reduce the quality of the inputs which make up their product or service. The side effect of doing so would be that they would provide their customers with a lower quality product or service but maintain their margins.

What tends to happen is that the producer chooses either option one or three in order to take the path of least resistance and reduce a potential hit to their bottom line. We, therefore, have this byproduct of inflation whereby the producer now has to either raise the price of the product or service or deceive the consumer by lowering the quality of their product or service. Both of which leads to the consumers losing out.

Second, let’s look at the effects of inflation from an asset perspective. As inflation devalues the currency’s purchasing power, it causes both the price and demand of assets to increase, which in turn artificially increases scarcity. This creates knock-on effects in the form of conflict and social unrest, as disputes arise over ownership of assets. Monopolization then tends to ensue in order for those in power to maintain control due to the increasing scarcity and price of assets. We then have the bigger issue, whereby huge wealth inequality between the holders of these assets and the holders of the currency starts to appear as the currency loses purchasing power. This can be seen in the lagging average hourly wage in relation to assets in the chart below.

What’s worse, is that over the last decade this lagging of wages to asset prices has only increased (as shown in table 1 under the Jan 2010–Jan 2021 column). This has caused one of the greatest transfers of wealth from the lower class to the upper class in recent history (chart below).

To play devil’s advocate, when inflation was initially implemented, the central banks had good intentions. Inflation in the form of monetary expansion, or interest rate adjustment, is a way for the Federal Reserve to attempt to dampen short-term volatility by stimulating the economy in times of stress. However, the issue is that volatility is just energy, which as we know from the first law of thermodynamics, cannot be destroyed. Instead, it is just transmuted, and so by trying to prevent/dampen short-term pain in the economy, this instead delays the pain and amplifies its future effects. This is why the initial bump in debt, in the form of monetary and fiscal stimulus in times of stress, evolves into this beast of constant debt expansion in order to prevent economic collapse.

The Federal Reserve may argue differently, but the saying, “there is no such thing as a free lunch,” still applies to monetary and fiscal stimulus. By stimulating the economy, what they are really saying is “I choose to shift money toward one area of the economy and away from another area.” This other area of the economy ends up getting the short end of the stick, which is nearly always the lower class. No matter how the Fed portrays it, stimulus in the form of inflation, helicopter money or the adjustment of interest rates will always have negative side effects.

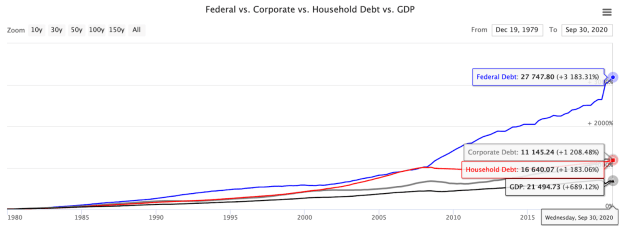

So why can’t we just stop this monetary intervention in order to close the wealth gap? Earlier, we mentioned the deflationary headwind. In order to understand this, we have to take a look at the current state of the U.S. debt situation. Combined, federal, corporate and household debt add up to $55.26 trillion against a GDP of $21.49 trillion (as shown below). This gives us a total debt to GDP of 257%.⁹ Simply put, for every $1 of GDP, there is $2.57 in debt. Let’s assume, conservatively, that the average interest on this debt is 3%. This would mean that, in order for the United States to service just the interest payment on its debt alone, it would need to grow by 7.71% year over year before we see any real growth in GDP.

We then come to the realization that the central bank is stuck between a rock and a hard place. They could let the United States go into a deflationary debt spiral, which would effectively cause the economy to collapse. Alternatively, they could maintain low interest rates and continuously expand the monetary base through inflation, hoping and praying that this intervention will lead to meaningful, productive growth in the economy, allowing the United States to start paying down its debt burden. So far, it looks like the central bank is choosing the latter option of relying on hope. This means it is highly unlikely we will see this debasement of the dollar stop anytime soon.

This then makes us question that if inflation is truly happening, then: Why are we not seeing the USD collapse against other currencies? This is not just a problem in the United States but a global issue. If you think the U.S. debt to GDP is a problem at 257%, globally we are sitting at 356%.¹¹ You’ve probably heard the saying “a rising tide lifts all boats.” This quote hits the nail on the head and is the reason we are not seeing the dollar lose value against other currencies. Every other major fiat currency is in the exact same situation. They are all printing away, trying to outrun their own debt burden and are, therefore, all being debased at a similar rate.

You may then wonder, how can this be the case for all countries? In simple terms, we have another negative feedback loop. Let’s say you have countries A, B and C. If A and B decide to debase their currency through inflation, then C’s currency strengthens against A and B’s. A and B are now struggling to trade with C because of the strength of its currency and they decide to reduce trade with C, primarily trading between themselves. C is then forced to debase its currency in order to maintain its trade relationships so that this reduction in trade does not persist and impact its economy. This cycle then repeats as each country continues to debase in order to keep up with one another. Every country is essentially in a rat race to the bottom, where, in the end, all fiat currencies will be worthless.

Why are we not seeing interest rates rise due to the inflationary effects of monetary expansion? The central banks around the world cannot let interest rates rise. From the calculations above, the U.S. GDP has to grow by 7.71% just to service the interest on its debt, assuming a 3% interest rate. If interest rates were to move up to 5%, then the United States would have to grow by 12.85% to service the interest on its debt. This is why we are seeing countries such as Japan and Australia capping interest rates through yield curve control in order to prevent rates from rising too high. Any meaningful rise in rates could be catastrophic to the economy.

It becomes evident that due to the manipulation intervention from the central banks globally, we cannot use our traditional metrics for tracking inflation such as interest rates and currency exchange rates. Additionally, if you are trying to get ahead by investing in assets, the Consumer Price Index (CPI) isn’t going to help either since it is just the average price of a basket of consumer goods and services. It doesn’t include assets such as stocks, real estate and bonds. Central bank intervention is clouding price and inflation signals on both micro and macro levels and, therefore, impacting economic decision-making. We have very few metrics these days to rely on which are not manipulated.

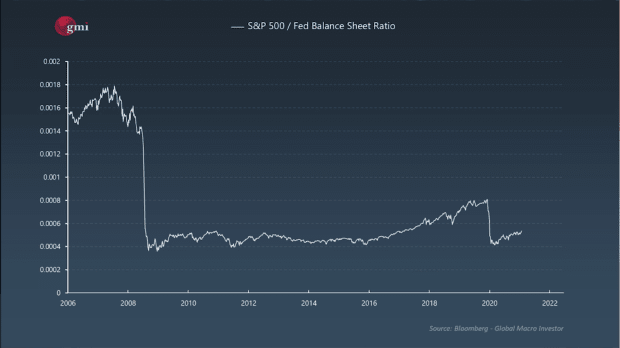

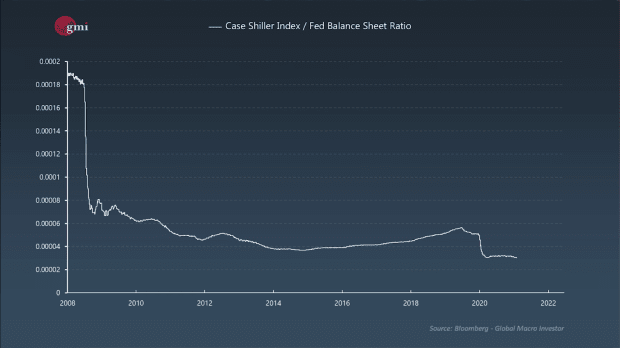

By now you may have reached the conclusion that if you just invest in real estate, stocks and a small allocation of gold, you should be outrunning this debasement of the dollar. I wish it was that simple. When we change the lens through which we view these assets, a different picture emerges. Instead of using the USD as the denominator, let’s see what happens if we use the Federal Reserve balance sheet.

What begins to emerge is that these assets aren’t really seeing the huge price appreciation that we’ve been led to believe. Instead, these assets are struggling to keep up with the debasement of the USD, all while the average worker, holding dollars, is drastically losing purchasing power (Table 1). It then becomes clear that this monetary expansion is the reason for the ever-increasing wealth inequality. Until we see a reduction in monetary intervention, or a new alternative sound currency, asset holders, and more specifically equity holders, are going to continue to dominate, while the middle and lower class will get crushed. What’s worse is that behind this facade of rising asset prices, everyone, including the investors, is getting screwed. Unless you invest wisely, you will struggle to outrun the debasement of the USD.

This then begs the question, how much expansion is going on under the hood of the Federal Reserve balance sheet? If we go to the Federal Reserve website,¹³ we can see that the Fed’s balance sheet has increased from $870 billion in July 2007 to $7.793 trillion in April 2021. That’s an annualized growth of 17.33%. This is the hurdle that we have to overcome just to stay ahead of the debasement of the USD. With this expansion, there is always a fear of uncontrollable inflation and prices across the board running away from us. We have seen this occur in dollar terms, especially in asset prices over the last decade. However, when we use the Fed’s balance sheet as the denominator, although there are periods of transitory growth where certain assets outperform, overall, we see underperformance.

To put the 17.33% hurdle into perspective, here are the 15-year annualized returns of various asset classes:¹⁴

- Large Cap Stocks — S&P 500 Index: 9.88%

- Small Cap Stocks — Russell 2000 Index: 8.91%

- International Developed Stocks — MSCI EAFE Index: 4.97%

- Emerging Market Stocks — MSCI Emerging Markets Index: 6.95%

- REITs — FTSE NAREIT All Equity Index: 7.15%

- High Grade Bonds — Bloomberg Barclays U.S. Agg Bond Index: 4.4%

- High Yield Bonds — ICE BofA U.S. High Yield Index: 7.44%

- S&P U.S. Treasury Bill 0–3 Mth Index: 1.11%

- Gold: 7.08%

- Real Estate: 2.28%

Not a single asset class in that list outperformed the 17.33% hurdle rate. In other words, if you had invested in any of the above asset classes, with a simple buy and hold strategy, you would have lost purchasing power over the last 15 years. Unless you are outrunning the 17.33% rate of monetary expansion through smart investing, you are losing purchasing power. It is as simple as that.

Unless the premise of our monetary policy changes (i.e., we shift toward an Austrian economic approach¹⁵), I doubt we will see any true, long-term, meaningful growth in assets and in the economy. Rather, the more likely scenario is that the Fed will continually debase the currency and inflate the debt burden. The dollar will continue to lose purchasing power, expanding the ever-growing wealth gap, and the Fed will keep pushing the narrative that everything is hunky dory and stable in the economy.

We have to make some big changes to the way we operate. We must change how we approach monetary policy and ensure that the people in power take accountability and keep its population’s best interests in the foreground. However, these issues have been talked about ad nauseum and so I wanted to bring up a few others:

Banking System

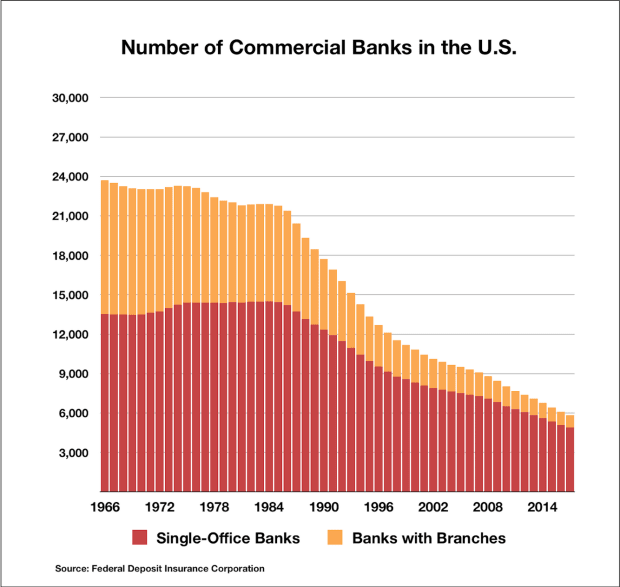

Small banks facilitate and lend to small businesses, while big banks facilitate and lend to big businesses. What is scary is that, since the 1960s, we have seen a decline from around 24,000 banks in the United States to below 6,000 banks today (chart below). This is due to the implementation of legislation which encourages expansion and mergers, while also making it very difficult for small banks to survive due to the hoops they must jump through. In the current banking environment, a select few banks dominate the industry.

Why does this matter? It matters because over 90% of the business population in the United States is represented by small- and medium-sized businesses. Small businesses are a major driver for economic growth and innovation. These same businesses need the small banks in order to survive. They need the ability to borrow in order to innovate and grow by using these funds to help increase productivity, boost efficiency and adopt new technology to keep up with competition. If small businesses are unable to borrow, this has major implications on economic productivity and growth.¹⁷

In order to promote small business growth — which as we know adds jobs, fuels innovation, and increases workforce productivity — we need to change our current approach to banking. Rather than lobbying for legislation which encourages consolidation and mergers within the banking sector, we need to reduce the requirements for small banks in order to promote the proliferation of small branches throughout communities.

Countries such as China¹⁸ have recognized this need for small banks in order to spur on productivity, innovation and growth. In return, China is one of the largest export countries as a percentage of GDP. They have also seen a big impact on their levels of poverty. China’s percentage of residents living below the poverty line has dropped from 98.3% in 1990 to 24% in 2016. During this same period, the United States’ lower class has slowly increased in size,¹⁹ while their stock market and housing prices have concurrently continued to climb higher and become farther out of reach for the average person.

School Of Hard Knocks

Realistically, we are probably too late to implement the school of hard knocks approach due to the size of the debt burden and the systemic issues within the economy. Regardless, we need to stop kicking the can and backstopping the big corporations and big banks every time we hit a speed bump in the economy.

During the mid-1900s, Yellowstone National Park introduced a protocol to extinguish any small forest fire.²⁰ They believed that they were detrimental to the local flora and fauna and were an eyesore for tourists. What they failed to realize is that forest fires are a natural part of the forest’s life cycle and occur in order to clear kindle and brush accumulation, while promoting biological growth and diversity. In 1988, after years of preventing the smallest of fires, enough brush and kindling had accumulated that the park had a fire which wiped out 36% of the forest.

We are currently seeing this play out in our economy. By propping up the economy every time we hit a speed bump, we are

a) Encouraging malinvestment: As people begin to get overly comfortable that the central bank or government will intervene during times of stress, we see a rise in excess speculative leverage in order to maximize returns. This consequently leads to unsustainable growth and thus amplifies the fragility of our economy.

b) Magnifying the wealth gap: With this overhanging debt burden, the central banks have little option but to debase the currency and maintain low interest rates in order to prevent a systemic collapse. This monetary expansion causes a rise in asset prices, all while the dollar’s purchasing power continues to diminish. As we know, the wealthy hold assets while the lower class holds cash, thus creating an ever-expanding wealth gap.

c) Constricting innovation: A zombie company is one which is unable to financially support itself. This is a sign that the product or service the business offers either does not have enough demand, or that the business has been irresponsible with its finances and is unable to service its debt. This business should, therefore, restructure or dissolve. We should allow the natural life cycle of a business to play out rather than prop up unsustainable companies. When a new business has to compete with an ever-increasing number of zombie companies, this makes it all the more challenging for that business to succeed and prosper. This is because instead of focusing on innovation, the business must use a portion of its resources to compete. As of July 2020, 19% of listed companies in the United States are zombie companies and this number is rising.²¹

Recessions are a natural part of the economic life cycle as they cause introspection which leads to innovation and change. They wipe out bad actors who have taken on too much leverage and invested poorly. Overall, recessions have a positive effect on the economy and it is shortsighted to intervene and attempt to manipulate the outcome.

Education

The millennial generation will be the first to be poorer than its parents,²² and this is not a theme we wish to see for generations to come. In order to break this cycle, we need to adjust the curriculum we teach in schools and add:

- Financial literacy: It is important to teach the foundation of smart investing by introducing children to the various asset classes and terminology within the financial system. This will promote a shift toward better money management, which will, in turn, create a reduction in unnecessary consumption due to a better understanding of the preservation and growth of wealth through investing.

- Education on how our monetary system works: This will give children a better understanding of how our monetary system is structured. In turn, this will allow them to better understand the monetary policy and motives behind the people they vote into power.

Introducing financial education into the curriculum allows individuals to feel more empowered to take control of their finances. Without a change in our educational system, we cannot expect an increase in financial literacy.

Debt

Globally, we must be more conscious in how we approach debt. Debt can be separated into three main categories:

- Consumption debt: Debt used for consumption purposes (i.e., cars, clothing and technology). This debt tends to be through credit cards and lines of credit.

- Asset debt: Debt used for the purchase of assets (i.e., home equity line of credit, mortgage and investment margin). This debt tends to be through banking institutions and brokerages.

- Productive debt: Debt used for productive business purposes in order to facilitate growth or for the purchase of product and tools which aid in productivity, technology and innovation.

Economic prosperity and growth is determined by how effectively technology interacts with the three drivers of production: land, labor and capital.²³ However, in order to increase economic productivity and create sustainable growth, we have to ensure we are evenly distributing our efforts between all three drivers. If we place more weight into one of these drivers, economic growth will initially rise. However, if we continue on this trajectory, economic growth will flatten, and eventually this overuse will act as a headwind, leading to reduced economic growth.

In the current economic climate, there has been an overuse of capital in order to continuously stimulate the economy. We are now at the point where this overuse has caused a large increase in consumption and asset debt in order to achieve perceived economic growth. In reality, we are not seeing any meaningful growth. Instead, we are merely creating a headwind in the form of an ever-expanding debt burden. We must focus our energy on utilizing debt in more productive ways by reducing this abuse of consumption and asset debt and promoting productive debt use. This shift in the way we utilize debt will aid the other two drivers of production, land and labor, and, in turn, create meaningful economic growth.

This leaves us with the question: What can I do in the short term as an individual? We need to put our money to work and have to decide on which asset(s) to invest in. However, not all assets are created equal. If everyone was given $1,000,000, then you’d assume the ones who hadn’t already done so, would go out and purchase a house and we’d all live happily ever after. Bear in mind that a small portion of the population already owns the majority of property. Initially, the early birds would start purchasing property. However, due to the amount of money entering the property market, the supply/demand imbalance would cause house prices to rocket and the laggards would be priced out once again thus maintaining the current wealth inequality. We have to find assets which are able to outpace the standard asset classes (real estate, equities and gold) and ideally outpace the debasement of the USD in order to meaningfully build wealth and slowly close the wealth gap.

Enter bitcoin. Bitcoin may not only be financially beneficial over the short to long term as a way to build wealth, but it may also be a potential solution to the social issues we are currently facing in societies around the world. Because of this, I want to approach bitcoin from both a financial and a social perspective.

How Can Investing In Bitcoin Benefit Us From A Financial Perspective?

First, with the current manipulation of the monetary system, it is not hard to see that we do not have natural, free market interest rates. This poses a major systemic issue whereby all equity, real estate and fixed-income valuation calculations are based on interest rates as the main input. If your main input to a calculation is grossly off, then how can you trust the output of that calculation? We may have the most fragile, overvalued financial system in history, and if rates are to rise just a few percentage points, we could see this house of cards fall. Bitcoin may potentially be a great hedge to a collapse of the financial system due to its decentralized, immutable nature without counterparty exposure.

Second, bitcoin is one of the few assets which has managed to outrun the debasement of the USD. Since its inception in 2009 until April 2021, it has achieved a compound annual growth rate of 256.87%. You may hear people say that bitcoin is a bubble and I am not going to go into all the rebuttals to the various arguments (there is plenty of information online regarding any questions you may have). However, it is important to note that bitcoin has a fixed supply of 21 million coins versus the ever-expanding USD. This scarcity is one of the main drivers which gives bitcoin its value, and the longer this monetary expansion experiment goes on, the greater the demand for bitcoin will become as people look for a life raft to escape the sinking fiat system.

How Can Investing In Bitcoin Benefit Us From A Social Perspective?

First and foremost, I believe that the government does have a place in society. Its purpose is to establish justice and domestic tranquility, provide common defense, promote general welfare and maintain liberty for its population. However, the government’s primary interest should be its people, not itself, and definitely not a small portion of its population. We have to ensure that the government is held accountable and keeps our interests at heart. If it becomes too overbearing, then we have to stand up and enact change. When true governance is in place, we should see growth in welfare, productivity and innovation, all while giving everyone equal opportunity to grow as individuals.

One of the major flaws in our current system is that we do not have a sound currency. Instead, we have placed the power of the monetary system into the hands of the central bank, which the government has a major influence over. It is inevitable that the government will use its authority to manipulate the monetary supply in order to maintain and grow its power. We, therefore, have a conflict of interest. People want to be capitalistic, while the government on the other hand is inherently anti-capitalistic and wants to maintain control. Bitcoin has the ability to change this flaw in the system.

If bitcoin becomes increasingly prevalent, we will see the positive side effects of having a true sound currency. Taking away the government’s ability to manipulate the currency, which in turn puts the power back into the hands of the individuals, causes the government to be more fiscally conscious while also ensuring that it is acting in the best interest of its population.

Why would bitcoin transfer power to the individual? Bitcoin is the first asset which is truly portable, immutable and decentralized. Additionally, it is not the bank, institutions or government which grant individuals access to their bitcoin, but rather the individuals themselves who have sovereignty over their bitcoin. Therefore, if the government becomes too onerous, then the individual can pack up and leave. Technology is breaking down land constraints which traditionally gave governments part of their power.

This, however, is not the case with traditional assets. Any meaningful amount of cash or gold tends to be stored in a bank, which the bank can restrict access to. Property is immovable and, therefore, can be seized and financial assets held in brokerage accounts can be frozen. This gives power to the governing body or third parties, which have custody over our assets. This means that, in a centralized currency, the power is in the hands of the issuer, whereas in a decentralized currency the power is in the hands of the holder.

If you live in a developed country and believe that the government has your best interests at heart, then it may seem like decentralized currencies are trying to fix a non-issue. However, as we have seen throughout history, the relationship between the people in power and the general population can turn very quickly and we have to ensure that the government continues to act in the best interests of its population. Furthermore, this is not the case for many individuals around the world who do not have comfort and stability within their country. For example, when Greece went into recession in 2016,²⁴ in order for the government to fund its liabilities it froze bank accounts and confiscated people’s cash holdings. What’s worse, is that in many developing countries women are unable to open bank accounts without a male signatory.²⁵ Therefore, they are unable to save and improve their circumstances. In both situations, bitcoin has the ability to give the individual back their freedom.

As with anything, it is important to be realistic. Therefore, we have to accept that in a capitalistic society, if bitcoin becomes a fundamental asset in the monetary system, we will most definitely see some form of wealth inequality. This is inevitable. However, fairness and equal opportunity are of utmost importance, and a sound decentralized currency such as bitcoin offers the best chance of achieving this. What is special about bitcoin is that, due to its lack of manipulation, we can only earn/obtain bitcoin by means of work or the sacrifice of resources. This allows bitcoin to act as a voting mechanism which channels truth and innovation by allowing ideas that provide value to rise to the top. This is not the case for the USD. The central bank and the government are in control of how the USD is distributed. This grants them control over who can and cannot use the currency, which in turn gives them the power to decide who succeeds and who fails.

In its short 12-year lifespan, bitcoin is well on its way to creating global social change and for the first time ever allowing people true control over their personal wealth. Over the next few decades, I believe bitcoin will be a force to be reckoned with.

Finally, I believe that investing is not just about financial gain. It is important to invest consciously, to invest with a long-term time horizon, and to invest in assets which have both a positive social and economic impact. Although nobody really knows what a world with a cryptocurrency at the core of its monetary system would look like, it is important that we start discussing potential alternatives to our current fiat system. From everything we now know, our current way of operating is simply not working, and the further we continue on this trajectory, the greater the potential consequences will be.

References

- Frank, Silvan. “US Debt to GDP.” Longtermtrends, 2020, https://www.longtermtrends.net/us-debt-to-gdp/. Accessed April 28, 2021.

- Fridman, Lex. #176 — Robert Breedlove: Philosophy of Bitcoin from First Principles. Apple Podcasts, 2021, https://podcasts.apple.com/ca/podcast/lex-fridman-podcast/id1434243584?i=1000517562151.

- Yahoo Finance. “S&P 500 (^GSPC).” Yahoo Finance, 2021, https://finance.yahoo.com/quote/%5EGSPC/history/. Accessed April 28, 2021.

- K. P. “Historical Home Prices: Monthly Median Value in the US from 1953–2020.” DQYDK, 2020, https://dqydj.com/historical-home-prices/. Accessed April 28, 2021.

- GoldPrice. “Historical Gold Prices.” Gold Price, 2021, https://goldprice.org/. Accessed April 28, 2021.

- Economics, Trading. “United States Average Hourly Wages.” Tradingeconomics, 2021, https://tradingeconomics.com/united-states/wages. Accessed April 28, 2021.

- FRED. “Share of Total Net Worth Held by the Top 1% (99th to 100th Wealth Percentiles).” FRED, 2021, https://fred.stlouisfed.org/series/WFRBST01134. Accessed April 28, 2021.

- FRED. “Share of Total Net Worth Held by the 50th to 90th Wealth Percentiles.” FRED, 2021, https://fred.stlouisfed.org/series/WFRBSN40188#0. Accessed April 28, 2021.

- Frank, Silvan. “US Debt to GDP.” Longtermtrends, 2020, https://www.longtermtrends.net/us-debt-to-gdp/. Accessed April 28, 2021.

- Frank, Silvan. “US Debt to GDP.” Longtermtrends, 2020, https://www.longtermtrends.net/us-debt-to-gdp/. Accessed 28 4 2021.

- Rabouin, Dion. “Global Debt Soars to 356% of GDP.” Axios, 2021, https://www.axios.com/global-debt-gdp-898959ed-f96a-4c4d-85a3-5d3cc419631f.html. Accessed April 28, 2021.

- RealVision. “The Exponential Age: Crypto’s Fast and Furious Rise.” RealVision, 2021, https://www.realvision.com/shows/expert-view-crypto/videos/the-exponential-age-cryptos-fast-and-furious-rise. Accessed April 28, 2021.

- FRED. “Assets: Total Assets: Total Assets (Less Eliminations from Consolidation).” FRED, 2021, https://fred.stlouisfed.org/series/WALCL. Accessed April 28, 2021.

- Novel Investor. “Annual Asset Class Returns.” Novel Investor, 2021, https://novelinvestor.com/asset-class-returns/. Accessed April 28, 2021.

- Hall, Mary. “The Austrian School of Economics.” Investopedia, 2021, https://www.investopedia.com/articles/economics/09/austrian-school-of-economics.asp. Accessed April 28, 2021.

- ILSR. “Number of Banks in the U.S., 1966–2017 (Graph).” ILSR, 2019, https://ilsr.org/number-banks-u-s-1966-2014/. Accessed April 28, 2021.

- DiMartino Booth, Danielle. “How Banks Work & Dictate the Economy.” Youtube, 2021, https://www.youtube.com/watch?v=u8j51XZegsk. Accessed April 28, 2021.

- Macrotrends. “China Poverty Rate 1990–2021.” Macrotrends, 2016, https://www.macrotrends.net/countries/CHN/china/poverty-rate. Accessed April 28, 2021.

- Kochhar, Rakesh. “The American Middle Class Is Stable in Size, but Losing Ground Financially to Upper-Income Families.” Pew Research, 2018, https://www.pewresearch.org/fact-tank/2018/09/06/the-american-middle-class-is-stable-in-size-but-losing-ground-financially-to-upper-income-families/. Accessed April 28, 2021.

- Yellowstone National Park. “1988 Fires.” National Park Service, 2021, https://www.nps.gov/yell/learn/nature/1988-fires.htm. Accessed April 28, 2021.

- Sharma, Ruchir. “The Rescues Ruining Capitalism.” The Wall Street Journal, 2020, https://www.wsj.com/articles/the-rescues-ruining-capitalism-11595603720. Accessed April 28, 2021.

- Lowrey, Annie. “Millennials Don’t Stand a Chance.” The Atlantic, 2020, https://www.theatlantic.com/ideas/archive/2020/04/millennials-are-new-lost-generation/609832/. Accessed April 28, 2021.

- Williams, Grant. The End Game Ep. 6 — Lacy Hunt. Apple Podcasts, 2020, https://podcasts.apple.com/us/podcast/the-end-game-ep-6-lacy-hunt/id1508585135?i=1000487560045.

- Joël Valenzuela, Joël. “Greece Seizes 500,000 Bank Accounts worth Euro 1.6 Bln, Escape With Bitcoin.” Cointelegraph, 2016, https://cointelegraph.com/news/greece-seizes-500000-bank-accounts-worth-euro-16-bln-escape-with-bitcoin. Accessed April 28, 2021.

- Merelli, Annalisa. “Two Maps Explain Why Women Can’t Raise Capital.” Quartz, 2018, https://qz.com/1176717/risk-averse-and-yet-untrustworthy-how-sexist-bias-affect-womens-access-to-credit-and-funding/. Accessed April 28, 2021.

This is a guest post by Sebastian Bunney. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.