- March 16, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoiners have speculated that computer technology corporation Oracle will announce a major bitcoin allocation. If it doesn’t, it should.

Following Tesla’s $1.5 billion purchase of bitcoin, Bitcoiners are patiently waiting for the next big-name institution to allocate their treasury to BTC.

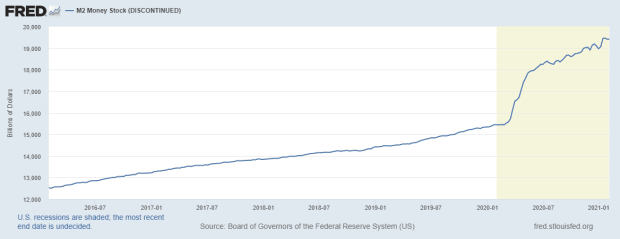

One of the most likely candidates is the computer software company, Oracle (Ticker: ORCL). According to its latest 10-Q report, Oracle currently sits on a massive $43.06 billion in cash and short-term investments, with $37.24 billion in cash only. It faces the same issue that every other corporation sitting on a large pile of cash does: As Michael Saylor would say, Oracle’s treasury is a melting ice cube, eroding away from the incredible rate of monetary supply expansion that has occurred over the last 12 months.

Looking at M2 money stock, there has been roughly $4 trillion added to supply since early 2020:

However, every company faces this issue, so why have many been speculating that Oracle will be the next to take an allocation?

Larry Elison, the executive chairman and CTO of Oracle, is known to be extremely competitive. In addition, he is a member of Tesla’s board. This means that he either was in support of the decision for Tesla to purchase $1.5 billion of BTC, or at least was in the room to hear the arguments made to convince the majority of the board to go through with the decision. Given that Oracle creates computer software company products, its board and executive team are likely to be technologically savvy; therefore increasing the likelihood that they would understand why Bitcoin is so valuable as an inflation hedge asset.

Oracle reported its earnings recently and it did not disclose that it had made a BTC treasury allocation. But if it were to do so soon, this would have an immense effect on the price, and due to game theory, the speed at which corporations move to take their own respective positions in bitcoin would also be affected as well.

It is interesting to note that the price has been increasing steadily over the last 24 hours. This could be completely coincidental, but there’s a possibility that market participants are speculating, or have insider knowledge of, a major announcement. In the days prior to Tesla’s announcement of its $1.5 billion purchase, there was a steady increase in price, possibly from insider knowledge of the ensuing announcement.

Regardless, on February 8, when it did make the announcement, biitcoin had a $7,500 daily candle, a roughly 20 percent increase. A similar increase in percentage terms would push Bitcoin’s price up to roughly $68,000.

Of course, this is all speculation, but something to keep in mind. Moving forward, it may seem attractive for other Fortune 500 companies to take a large position, announce it and instantly see price appreciation from the announcement.

This is a guest post by William Clemente III. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.