- May 18, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The country is a haven for the digital asset as it embraces the revolution of independent money.

The presence of bitcoin continues to accelerate in Argentina, a country that has been severely affected by government-sanctioned anti-free market policies. Citizens of Argentina have long utilized the U.S. dollar as a means to transact outside of the traditional system, yet bitcoin has been gaining traction in the country over the last few years. Recently, the Latin American director of digital exchange Binance told AFP News, “The number of user accounts for investing in ‘cryptos’ has multiplied by ten in Argentina since 2020,” detailing a staggering increase in the number of users.

The Economic History Of Argentina

Argentina entered the 20th century as one of the wealthiest countries throughout the entire world. Prior to World War I, Argentina was richer than the traditional European superpowers of France, Germany and their Spanish colonizers. The country continued to grow throughout the first half of the 20th century, albeit at a slower pace than the rest of the world but still maintaining a positive growth rate.

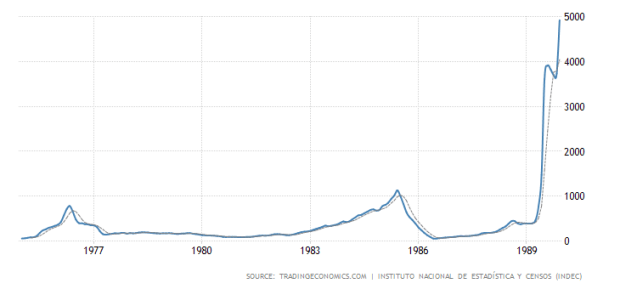

Yet, in 1975, the economic scenario in the country quickly changed; from 1975 to 1990, the country experienced economic stagnation and dramatic inflation. Starting in 1975, the government enacted the Rodrigazo, a series of centrally planned government policies that aimed to centralize economic decision-making. As a result, inflation averaged over 300% per year from 1975 to 1990, reaching severe hyperinflation rates of 2,600% in 1989 and 1990. These bouts of government-induced hyperinflation destroyed the savings of citizens preserving their wealth in the Argentintian peso and set the country into a devastating downward spiral.

Throughout the 1990s, Argentina had a law of convertibility that fixed the peso’s exchange rate at par with the U.S. dollar, meaning every peso had to be backed by a 1:1 U.S. dollar reserve ratio. This temporarily stalled inflation for about a decade, yet meant that politicians could not print exorbitant amounts of money. As a result of the government’s desire to increase spending, in 2001, they quickly enacted a series of government policies known as the Corralito. During this attack on economic freedoms in the country, the Argentinian government froze citizens’ dollar-denominated bank accounts within the banking system. Simultaneously, they altered the peso to USD exchange rate then proceeded to steal the dollars within the banking system as all were converted to Argentinian pesos under the new exchange rate, simply to finance government spending at the expense of the common citizen.

The Present Economic State Of Argentina

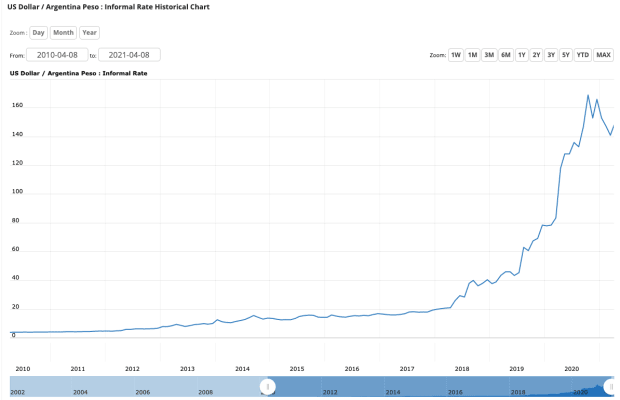

After the Corralito, the economy had a slight return to growth as government-imposed restrictions were slowly lifted from 2002 to 2012. In 2012, rising inflation and capital flight led to a massive decrease in the country’s dollar reserves pushing the government to enact new capital controls, specifically centered around limiting citizens’ access to U.S. Dollars. These capital controls led to a steady increase in the black market for dollars transacted outside of the traditional banking system, known as the blue dollar rate.

From 2012 to 2015, capital controls continued to be enacted under President Cristina Kirchner, leading to a steady increase in the blue dollar conversion rate. Under President Mauricio Macri from 2015 to 2018, some capital controls were lifted, decreasing the size of the black market for U.S. dollars, yet the loosening of restrictions did little to prevent a steady rise in the blue dollar rate.

In August 2019, President Macri lost the primary vote, marking an end to the free-market policies the administration had instituted. This led to a massive stock market sell-off and currency devaluation as the peso dropped 15% in a single day. In September 2019, new capital controls were instituted that prevented citizens from converting pesos to dollars at a rate that exceeded $10,000 per month. A month later, after Macri officially lost the election, citizens were limited to just $200 of dollar savings from the previous $10,000 allowed.

Under the current Alberto Fernandez administration, capital controls have been greatly increased. The administration announced after entering office in December 2019 that all purchases made in any foreign currency would be subject to a 30% tax, hampering official avenues for citizens to transact with relatively stable fiat currencies such as the U.S. dollar. As of April 2021, the government has confirmed that all capital controls will remain in place for the foreseeable future, doubling down on policies that have destroyed the free market in Argentina, devalued the peso, and forced citizens to transact on the black market to maintain any level of prosperity.

A Steady Shift Toward Bitcoin

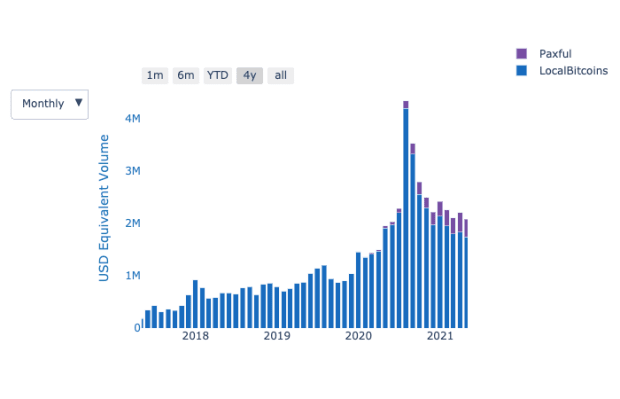

Coinciding with the new capital controls within the country, bitcoin adoption has been steadily increasing. The amount of peer-to-peer volume within the country has significantly increased since 2018 and is continuing to maintain a consistent volume.

As seen in the chart above, the clear upward peer-to-peer volume trend beginning in early 2020 coincides with new capital controls within the country. These volumes may continue to increase as the current administration recently confirmed that all capital controls will remain in place, a move that will induce capital flight and continue to force citizens to transact outside of the traditional financial system.

On the corporate side, South American e-commerce giant MercadoLibre, headquartered in Buenos Aires, Argentina, recently disclosed a $7.8 million bitcoin purchase, with plans to hold bitcoin on their balance sheet. The company has accepted bitcoin for payments since 2015, as a result of South American customers being relatively financially disadvantaged and effectively being forced to rely on bitcoin as a reliable payment method.

Bitcoin Can Empower Argentinians

Argentinians have been consistently robbed of their ability to preserve capital within their own country. Dramatic domestic inflation as a result of government money printing and heinous economic policies have forced citizens to abandon the peso for the U.S. dollar. Yet, in an attempt to finance government spending, citizens have had the only reliable form of currency outright stolen from them time and time again.

On the surface, bitcoin is the best savings technology in the world, providing an avenue for the citizens of Argentina to preserve their wealth in a perfectly constructed deflationary piece of technology. This is not bitcoin’s only usage for the economically disadvantaged citizens of Argentina; bitcoin cannot be censored or confiscated regardless of government intervention. This facet alone will allow Argentinians to prosper outside of the arms of a corrupt government that has consistently shown a disregard for the well-being of its citizens.

Bitcoin does not align with the goals and incentive structure of the Argentine government, but fills the goals of the average citizen to perfection. Argentinians now have the ability to opt out of a system that has treated them unfairly for decades.

Bitcoin is freedom money.