- May 25, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

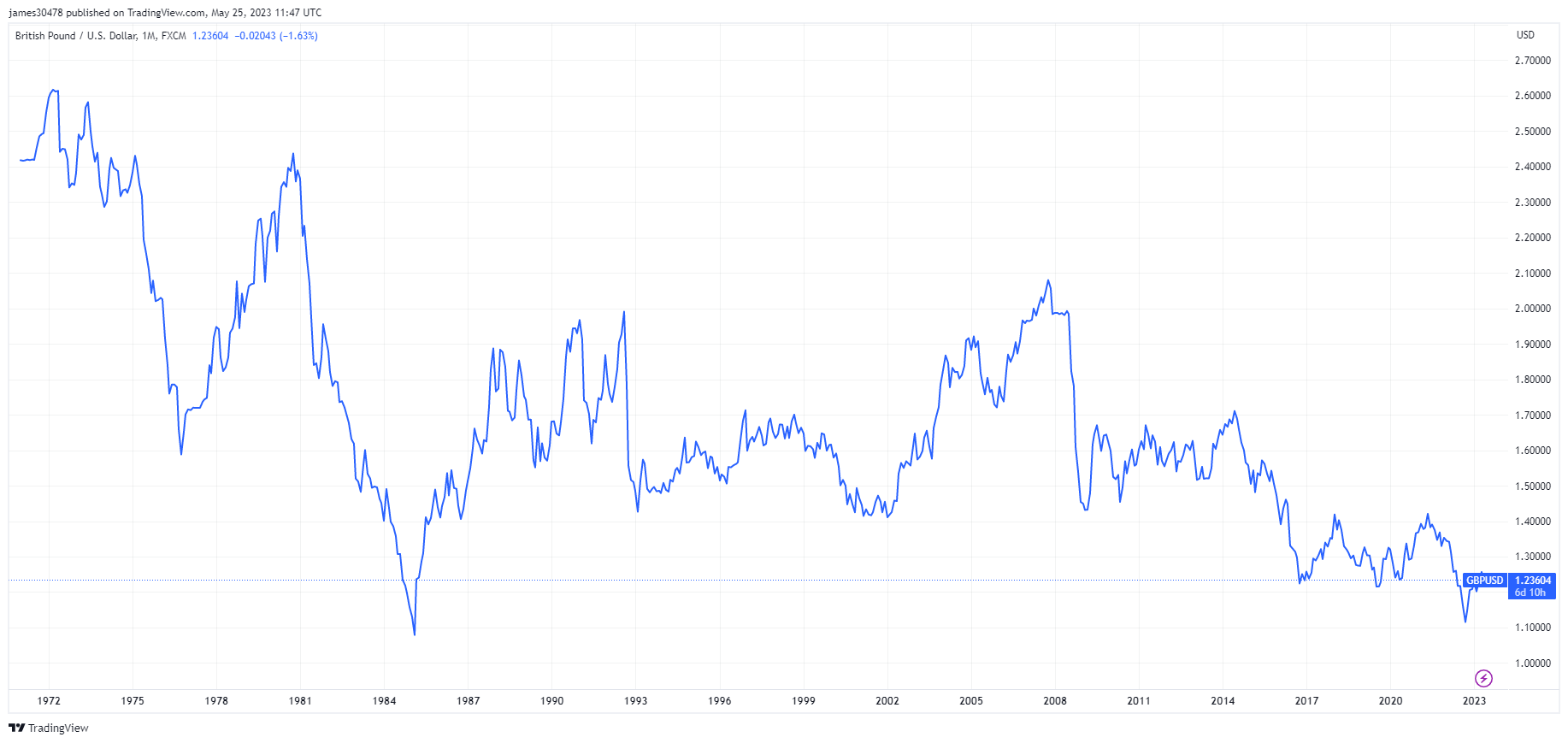

- Last October, U.K. Prime Minister Liz Truss introduced a “mini-budget” that triggered a pension fund crisis. The mini-budget episode sent shock waves around the UK markets and the GBP to 1.11 against USD.

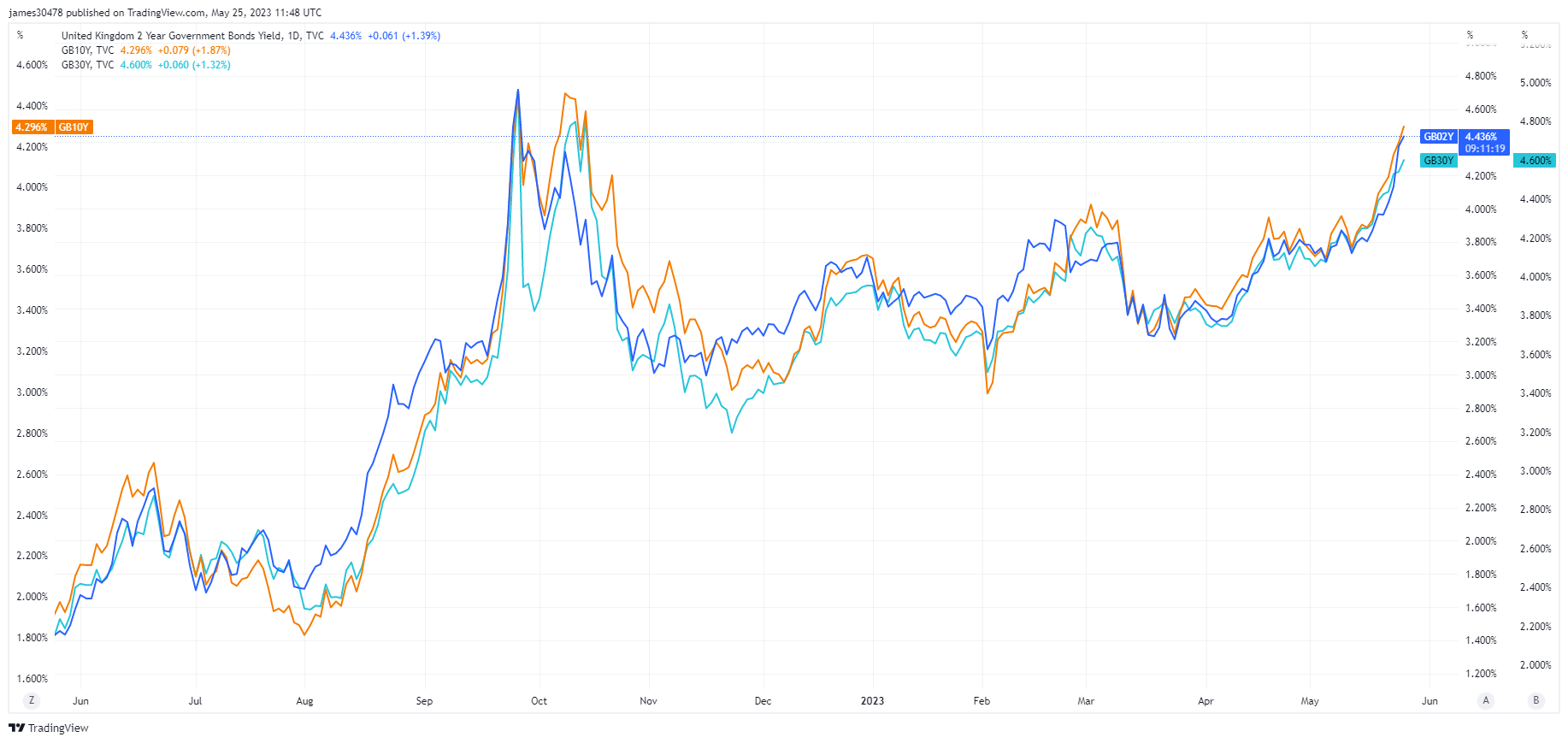

- In the wake of new inflation numbers yesterday, U.K. government yields have soared even higher.

- As yields soared across the curve—especially at the long end (30 years)—pension funds went downward.

- According to Bloomberg, pension funds use leverage to balance assets with liabilities.

- Pension funds have a significant allocation towards long-end bonds that are highly levered, so when the price of the bond drops, they need to post collateral not to be margin called.

- As gilt (government bond) prices continued to drop, pension providers were forced to raise cash imminently as the threat of margin call loomed.

The post UK yields skyrocket to levels echoing last year’s pension crisis appeared first on CryptoSlate.